When looking at your transactions, you now also have easy access to the features the app provides for the individual accounts. Hitting your goal quickly is always just a thumb click away. Navigating through the app is now much more intuitive: To do so, use the new navigation bar at the bottom of the screen.

With the new action bar positioned prominently at the top of the home page, the app offers you much faster access to the important things: sending money (with access to account and bank transfers, standing orders and giropay), searching transactions, blocking cards and many other app features. New, yet familiar: Version 6.0.2 brings several visual improvements: Sparkasse - Your mobile branch Version 6.0.2 13 March 2022 Sparkasse - Your mobile branch Version 6.1.1 Īs always, we've also included minor bugfixes. Version 6.2.1 also makes your banking app better again: We have fixed a few minor bugs. We have raised the security standards of the app and adapted them to the current circumstances. Sparkasse - Your mobile branch Customer Service, Editor Notes: Sparkasse - Your mobile branch Version 6.2.1 09 August 2022

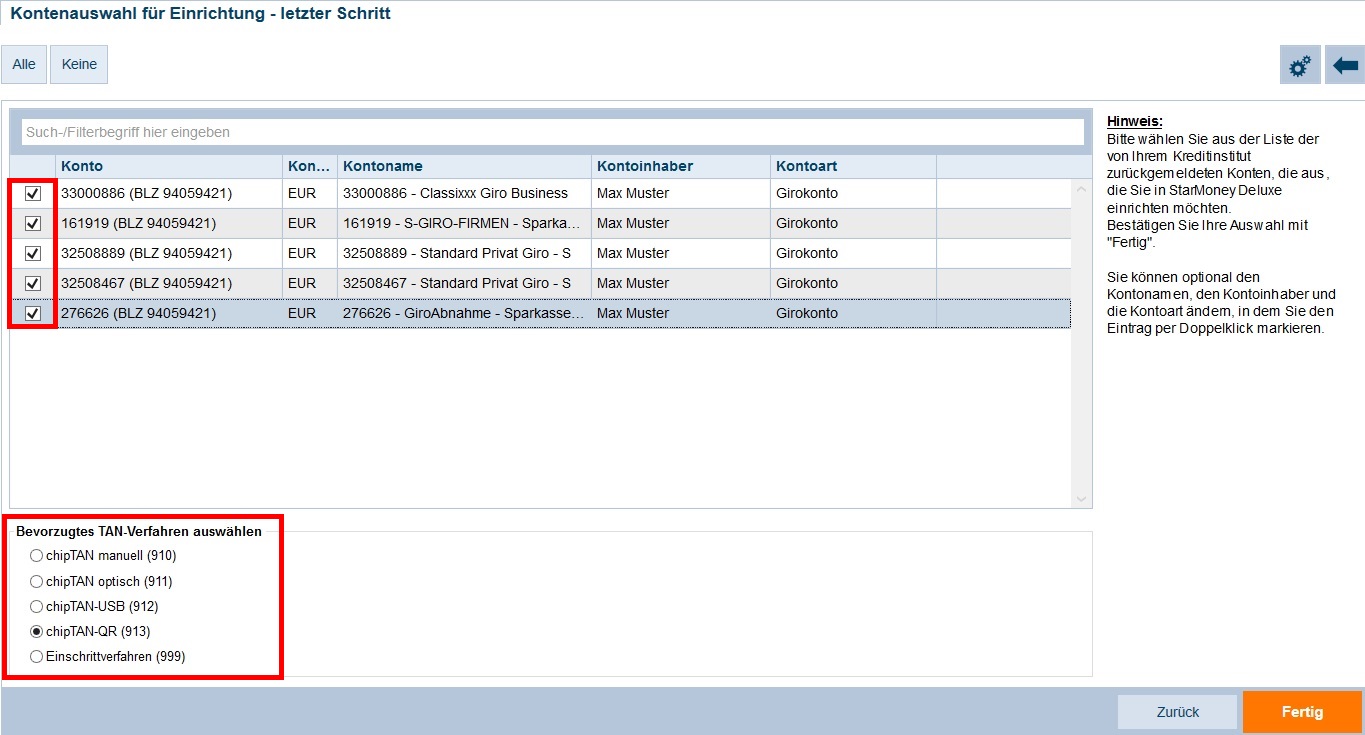

CHIPTAN STARMONEY LICENSE

By downloading and/or using the app Sparkasse, you accept the terms of the End User License Agreement of Star Finanz GmbH without restriction. We take the protection of your data seriously. giropay | Kwitt is at your disposal if it is supported by your Sparkasse or Bank. Please note that individual functions incur costs at your institute, which may be passed on to you. Please send support requests directly from the app. TAN methods supported for payment transactions are chipTAN manual, chipTAN QR, chipTAN comfort (optical), pushTAN smsTAN. You need an account with a German Sparkasse or Bank that has been activated for online banking (HBCI with PIN/TAN or FinTS with PIN/TAN). On top, you can switch directly to the app S-Invest and place securities. You have a direct line to your Sparkasse via app and access to many services such as card blocking, notifications, notepads, appointments and even the account opening via app (if offered by your Sparkasse). Use the search function across accounts and bank details, set up a budget book (offline account) for budget planning and view graphical evaluations of your finances. TÜV confirms the safety standards and re-tests them annually.

All finances are secured to the maximum in the event of loss. The autolock function locks the app automatically.

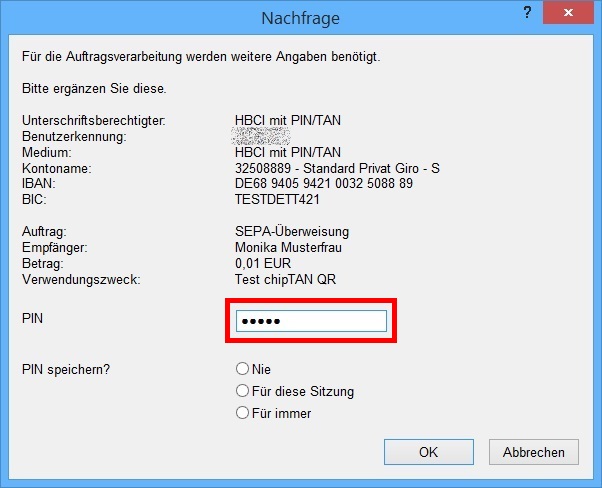

CHIPTAN STARMONEY PASSWORD

Access is protected by a password and optionally by Touch ID/Face ID. The app Sparkasse communicates via tested interfaces and ensures secure data transfer in accordance with the German requirements for online banking. If you use a high-quality, up-to-date banking app in combination with an up-to-date operating system and a secure internet connection, you don't have to worry about mobile banking. Activate your digital cards for the Wallet app. If you want to use Apple Pay, the app Sparkasse is a prerequisite. This is also possible if you borrow money or collect money for a gift. With giropay | Kwitt you’ll send money from cell phone to cell phone without delay. The salary alarm clock tells you when wages are received and the limit alarm clock lets you know when an account balance is exceeded or undercut.Ī cozy evening with friends at your favorite restaurant is something nice. If you want to know the accounts daily basis, set up the account balance alarm clock. The account alarm clock informs you promptly about account transactions. Instead, you can easily do everything with the iPhone/iPad. Annoying filling out a transfer form on the computer is no longer necessary. No matter whether you set up a standing order while traveling on train, settle your bill at the breakfast table with photo transfer or check the account balance and credit card transactions. The app Sparkasse will be there for you in all situations.

0 kommentar(er)

0 kommentar(er)